50% Subsidy for procurement of Pollution control equipment, captive power generation sets, etc.

Capital investment subsidy upto 50% on fixed capital investment for Micro and Small Enterprises.

The yearly Island Tourism Festival will be organised by the Tourism Department.

Subsidy for setting up of 1-3 Star Hotels/Budget Hotels/ Lodges/Dharshalas will be devised.

Electricity charges shall be reimbursed @ Rs.2.00 per Unit for a period of 5 years for all new Tourism Projects.

Reimbursement of 100% of stamp duty and transfer duty paid by the units on purchase of land for all new Tourism Units.

100% exemption of Land Use Conversion charges on conversion of land permitted by the Authorities.

Reimbursement of 100% of net SGST accrued to the State for all new Tourism units for a period of five years.

Upto 50% Stamp Duty exemption for all eligible new tourism units subject to a ceiling of Rs. 25 lakhs.

Upto 80% reimbursement of interest on loan taken for construction of tourism units.

30% Capital Investment Subsidy to be given on investments with an upper limit of Rs. 50 lakhs.

Upto 100% Quality Certification Subsidy subject to a ceiling of Rs. 20 lakhs per unit.

30% of capital investment subject to a ceiling of Rs. 5 crores.

Reimbursement of power subsidy @ Rs. 2.00 per unit consumed for a period of 5 years.

100% Stamp duty shall be reimbursed, subject to a monetary ceiling of Rs.25 lakhs.

Interest Subsidy of 2% on the outstanding working capital loan for five years subject to a ceiling of Rs. 50 lakhs.

100% exemption on land conversion charges.

100% exemption in Stamp Duty and registration fee in lease / sale / transfer of land for setting up a tourism project.

100% exemption in electricity duty for 7 years.

Exemption from Luxury Tax for first 7 years of commercial operations.

Reimbursement of 40% of the SGST to eligible tourism project for the initial 5 years of operation.

Upto 100% reimbursement of EPF Expenditure (employer`s contribution) for 3 years.

Incentive of 50% of the fixed capital investment in renewable energy generation to Eligible Tourism Projects.

100% reimbursement of electricity duty upto 5 years to Eligible Tourism Projects.

Special incentives for 100% women owned enterprises.

Incentives for industries that offer vocational and other technical training to local persons.

100% reduction in electricity duty for units installing renewable power generation equipment

Reimbursement of 25% of the cost of water and energy conservation equipment, subject to a cap of Rs. 100,000 per unit.

100% reimbursement of stamp duty and registration fee shall be provided.

Upto 20% subsidy on eligible capital investments made in tourism units.

Reimbursement of 50% of the certification fees to hotel/wellness resort obtaining Green Building Certfication.

100% exemption from electricity duty for a period of 5 years.

Exemption from Electricity Duty to the new tourism/hotel projects for a period of 5 years.

Upto 100% reimbursement of stamp duty on the land area meant for industrial use.

50% exemption towards External Development Charges.

Customized package of incentives and concessions to prestigious tourism /hotel projects having investment of Rs.30 crores and above.

Capital Investment subsidy upto 10% of Fixed Capital Investment to eligible tourism units.

Financial support of 15% of the total cost of construction of approach road to all eligible tourism units.

Rimbursement of 50% on paid Stamp Duty & Registration fee charges.

Assistance upto 75 % of the cost of carrying out Energy Audit to eligible tourism units.

Incentives at 15% of the eligible capital investment subject to a maximum limit to be decided by the Tourism department.

Subsidy @60% of the cost of pollution control devices subject to a maximum of Rs. 50 Lakhs.

Subsidy of 30% of the total cost incurred for obtaining Quality Certification, subject to maximum of Rs. 2 lakhs.

100% exemption of Stamp Duty on land transactions to new and existing units.

Reimbursement of Electricity Duty to new tourism units for a period of 5 years.

Assistance for obtaining quality certification @ 50% of the expenditure incurred up to maximum of Rs.10 lakhs.

Financial assistance of 50% of the expenditure incurred up to a maximum of Rs. 10 lakh per patent.

Special incentive of 50% reimbursement of fee will be given to SC/ ST and women for pursuing entrepreneurship course from a reputed institute.

Capital Investment Subsidy of up to 25% of total capital investment for eligible projects.

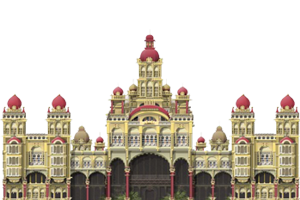

Industry Status Benefits for Star-Classified Hotels Industry status benefits provided to star-classified hotels of Karnataka.

Stamp Duty and Registration Charges 50% exemption of stamp duty and 100% exemption of registration charges for eligible projects.

Interest Subsidy 5% Interest Subsidy on term loan on fixed capital investment for eligible tourism projects.

Incentive of 15% on the total investment subject to a maximum ceiling limit of Rs 20 lakhs to investors classified under responsible tourism.

Marketing Assistance of 25% of the travel fare and promotional materials for service providers.

Industrial tariff on electricity charges applicable for the first 5 years for establishments to investors classified under responsible tourism.

Residential tariff on electricity and water charges for homestay providers to promote homestays in the state.

All new heritage hotel projects shall be exempted from paying Registration Fee and Stamp Duty.

Upto 100% Subsidy for Responsible Tourism to tourism units.

Capital Subsidy of upto 25% on fixed capital investment for eligible tourism units.

5% Interest Subsidy on term loan to eligible tourism units for 7 years.

Upto 100% Stamp Duty & Registration charges exemption for all eligible tourism units.

Upto 100% Electricity Duty Exemption for all eligible tourism units.

License renewal every 5 years instead of the present annual renewal.

Upto 100% refund of State Goods and Service Tax.

Subsidy of 2.5% on fixed capital to all eligible tourism units.

New industrial units will be eligible for concessional pre-paid meters.

The industrial units set up under this scheme can claim reimbursement of central share of income tax for first 5 years.

100% reimbursement of insurance premium on insurance of building for all eligible new tourism units.

Subsidy up to 75% of the applicable amount to assist execution of deeds of conveyance/mortgage pertaining to loans from financial institutions.

The industrial units set up under this scheme can claim reimbursement of central share of income tax for first 5 years.

Central Capital Investment Incentive for access to credit at 30% with an upper limit of Rs.5.00 crore.

100% reimbursement of insurance premium on insurance of building for all eligible new tourism units.

Power subsidy of upto 60% of total expenditure on power consumption to eligible tourism units.

Land Subsidy of 25% of the lease fee of allotted developed/undeveloped land to new eligible units.

Manpower development subsidy of 50% of the actual course fee for training to all eligible tourism units.

Upto 90% Subsidy on cost of Project Report to all eligible tourism units.

Reimbursement up to 25% of the actual wage bill for local tribal employees employed by eligible units.

50% Stamp Duty and Registration Fee exemption for securing loans from Financial Institutions.

Subsidy at 50% rate of the cost of Detailed Project Reports to eligible new units.

Up to 30% Subsidy on power tariff will be provided for a period of 5 years to eligible units.

100% reimbursement of the land conversion charges after the commencement of the commercial operation.

All eligible tourism projects with investments of Rs.20 lakh and above shall be eligible to get a capital investment subsidy.

New tourism units exempted from payment of electricity duty up to a contract demand of 5 MVA for a period of 5 years.

All new Tourism Units shall be eligible to get a 100% exemption in Stamp Duty on purchase of land for the project.

Upto 50% exemption on Property Tax for 7 years.

100% Exemption on Electricity Duty for 10 years for all Eligible units.

100% exemption from Stamp Duty for purchase or lease of land and building.

Reimbursement of 75% of net SGST for 7 years with a cap of 100% of FCI.

Industry Status to Tourism & Hospitality Sector Industry tariff applicable now - Electricity tariff 70%, Urban Development Tax 20% and Building Plan Approval charges 66% of commercial charges.

Investment Centric Tourism Unit Policy An exclusive investor friendly policy, no conversion and development charges, additional Built-up Area allowed, subsidized Bar license for Heritage Hotels, operating licenses for 10 years at once and Online approval of projects.

Incentives to Tourism & Hospitality Sector 75% upfront and 25% reimbursement of stamp duty, interest subsidy upto 6% for 5 years, 100% exemption in Electricity Duty & Land Tax for 7 year, Investment subsidy: 75% of SGST for 7 years, reimbursement of 50% of employer`s contribution towards EPF and ESI for 7 years, green incentives for water conservation, waste management, quality certification, etc., projects above 25 cr. investment are eligible for capital subsidy.

Rural Tourism Scheme Agro tourism unit, camping sites, caravan park, rural guest house allows, land use change and building plan approval not required, allowed outside municipal area, time-bound approval on the basis of self-declaration, 100% exemption in stamp duty, 100% SGST reimbursement for 10 years and 9% interest subsidy on loans upto Rs. 25 lacs.

100% income tax for a period of 10 years to all eligible tourism units.

Capital investment subsidy at 15% of their investment in plant & machinery, subject to a ceiling of Rs. 30 lakhs.

Interest subsidy of 3% on the working capital loan would be provided to all new tourism units.

100% reimbursement of insurance premium on insurance of building for all eligible tourism units.

Capital Investment Subsidy Subsidy of 25% up to 1.5 Crore for project sizes below INR 50 Crores and subsidy of 5% up to 3 Crores for Project sizes between INR 50 Crores and INR 200 Crores.

Interest Subsidy Interest Subvention of up to 5% for Eligible Tourism Projects below INR 50 Crores.

Quality Certification Incentive 100% reimbursement of Quality Certification Cost up to 2 Lakhs for National Certification and 10 Lakhs for International Certification.

Structured Package of Incentives for Projects above 200 crores including Investment Promotion Subsidy, Interest Subvention, Quality Certification Incentive and Green Industry Incentive.

Reimbursement of interest paid to banks/ financial institutions@4% on term loans for 5 years.

100% exemption on earnest money and security deposits to all eligible enterprises.

Employment Generation subsidy @50% of employer contribution paid towards EPF and ESI after 5 years of operations.

100% reimbursement of certification charges issued by national and international bodies.

Interest subsidy at 5% of the loan amount for eligible tourism units.

Land use conversion and development charges shall be waived off for all new tourism units.

100% exemption of stamp duty and registration fee to eligible tourism units.

Upto 25% subsidy on fixed capital investment to be provided to eligible tourism units.

Rebate of RS. 1 per unit and 100 % exemption on Electricity Duty.

100% exemption of stamp duty paid depending upon category.

Upto 100% SGST Reimbursemen for first 5 years.

Interest Subsidy of upto 10% to new tourism units for first 3 years.

Waiver of electricity duty on the electricity consumed its approved project for a period of 5 years.

Upto 70% reimbursement of amount on registration of documents within state for purchase or acquisition of land/ buildings/ property across all units.

50% of fixed capital investment expenditure will be reimbursed for quality improvement, modernization, etc.

All units are entitled for upto 75% interest subsidy on term loan borrowed from commercial bank and financial institution.